Introduction

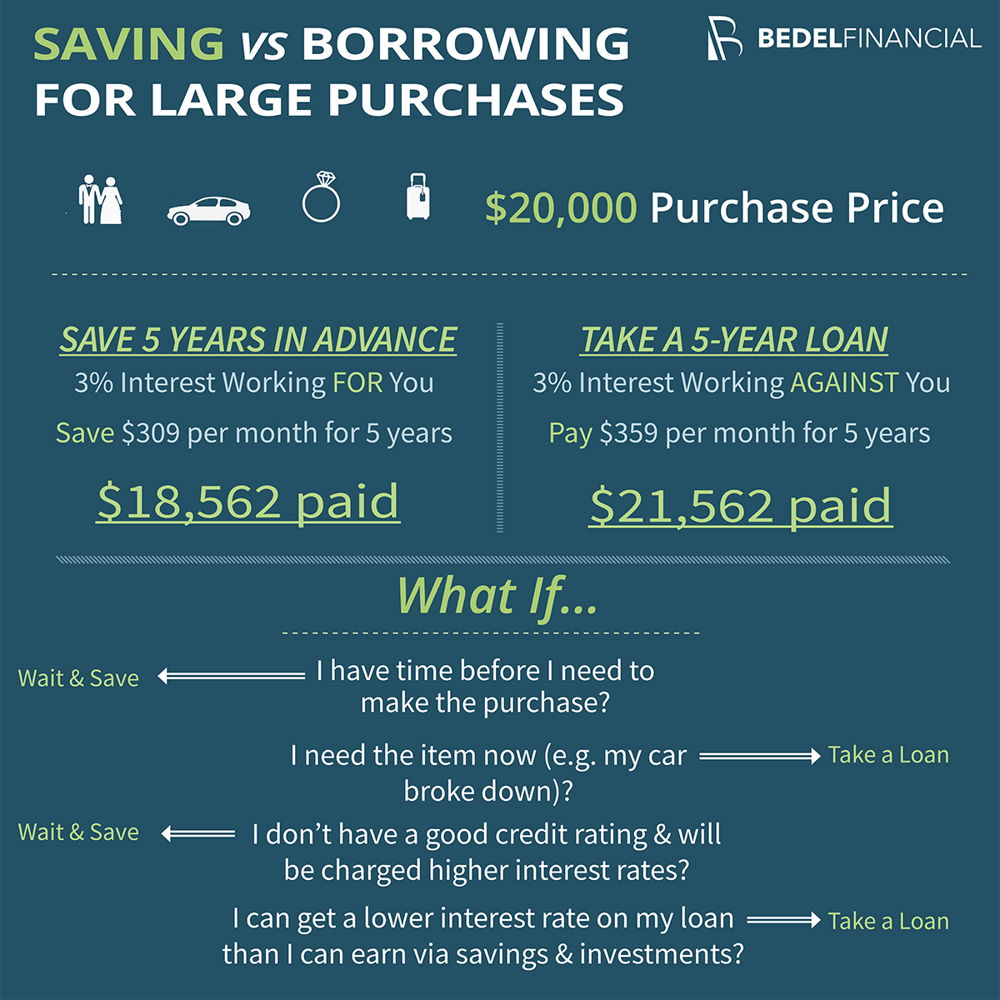

Nobody likes surprises when it comes to big expenses — whether it’s annual school fees, a major medical bill, a family function, or car repairs. Too often, people turn to credit cards, EMIs, or personal loans to bridge the gap. But borrowing comes at a cost — interest, stress, and financial pressure.

There is a simple way to pay for big expenses without taking loans, and it doesn’t require financial degree knowledge. It’s called a sinking fund — a smart budgeting strategy that helps you save gradually for large predictable costs, so when the bill arrives, you aren’t forced into borrowing. Moneycontrol

In this guide, we’ll break down exactly what a sinking fund is, how to set it up, how to make it work for big expenses you know are coming, and why this simple approach can help you avoid loans altogether.

What Is a Sinking Fund (And Why It Helps You Avoid Loans)?

The concept of a sinking fund is simple yet powerful. Instead of borrowing money when a large expense pops up, you save for that expense ahead of time — a little bit every month. Moneycontrol

How It Works

- Step 1: Identify a big cost you know will arrive in the future (like insurance, school fees, or a renovation).

- Step 2: Estimate its total amount.

- Step 3: Divide that amount by the number of months until it’s due.

- Step 4: Set aside that amount every month until you reach your target.

This strategy spreads the cost backward (retrospectively), so the payment feels smaller and manageable, instead of hitting your bank account all at once. The result? You improve cash flow and avoid loans or EMIs with interest charges. Moneycontrol

Why Loans Should Be Your Last Resort

Before we dive deeper, it’s worth remembering why not taking loans is often better:

🔹 Interest Costs Add Up

Loans, including personal loans and credit cards, charge interest that makes the effective cost much higher than the bill itself. For example, a ₹1.5 lakh loan at 12% interest can end up costing significantly more over a year than the original amount borrowed.

🔹 Debt Stress and Risk

Even low-rate loans increase your financial vulnerability — especially if your income fluctuates or unexpected emergencies arrive. Myths about loans often ignore the true total cost, including processing fees and EMIs. Moneycontrol

🔹 Reduced Financial Flexibility

Loans commit part of your monthly income to future payments, limiting other financial choices.

A sinking fund directly addresses these issues by helping you save first and pay later — without loan price tags.

When Is Using a Sinking Fund Ideal?

A sinking fund is best for predictable or recurring costs, such as:

- School or college fees

- Annual insurance premiums

- Property tax

- Car servicing/repairs

- Travel plans for festivals or vacations

- Major electronics replacements

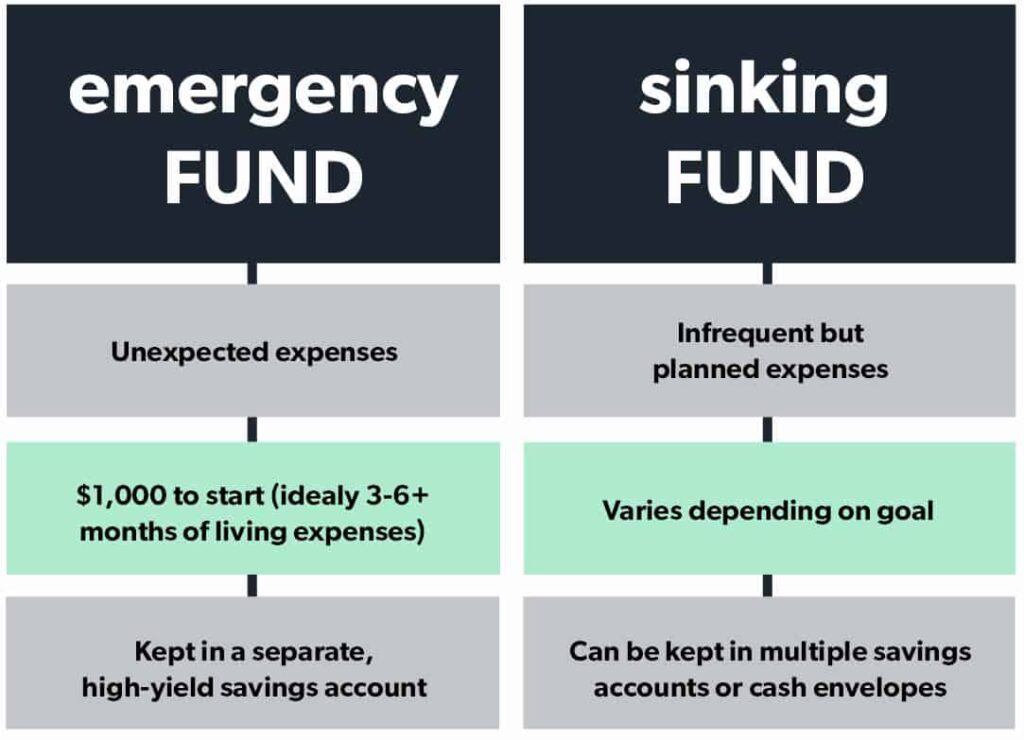

Unlike emergencies (which should be covered by an emergency fund), sinking funds are for anticipated expenses. These are expenses you know will come — you just don’t know exactly when or how much.

How to Set Up a Sinking Fund in 5 Steps

Here’s the simplest method for using the sinking fund approach to pay for big expenses without taking loans:

1. List Your Predictable Big Expenses

Identify all large costs you regularly face — next 6 months, 12 months, and even 24 months.

2. Estimate Expense Amounts

Use bills, past records, or online cost calculators to estimate how much each will cost.

3. Divide by Months Until Due

For example:

- If school fees of ₹60,000 are due in 6 months → save ₹10,000/month.

4. Automate Your Savings

Set up automatic transfers on salary day so you don’t forget or spend it first.

5. Keep Funds Separate

A dedicated savings or liquid fund prevents you from accidentally using the money for regular expenses.

This process may sound simple — because it is. Good budgeting doesn’t have to be complicated. Moneycontrol

Difference Between a Sinking Fund and an Emergency Fund

Many people confuse the two, but they serve different purposes:

🔹 Emergency Fund + Unexpected, urgent costs (job loss, medical emergencies)

🔹 Sinking Fund + Expected, planned large expenses

Your sinking fund complements your emergency fund — one protects you from unpredictability, and the other protects you from known big bills.

Sinking Fund Example: School Fees

Imagine you know your child’s school fees of ₹1 lakh are due in a year.

- ₹1 lakh ÷ 12 months = ~₹8,333/month

- You set aside ₹8,333 every month starting now

- After 12 months, you have ₹1 lakh without needing loans

Instead of worrying when the bill arrives, you already have the money, ready to pay. This is the essence of the simple way to pay for big expenses without taking loans. Moneycontrol

How Sinking Funds Improve Your Financial Psychology

This isn’t just about money — it’s about behaviour:

✅ Reduces Stress

Because you are prepared, not reactive.

✅ Removes Last-Minute Borrowing

No need for high-interest credit cards or loans just because timing didn’t align.

✅ Builds Financial Discipline

Allocating small amounts consistently creates better money habits — similar to investing early and regularly.

Financial behaviour matters as much as financial planning.

Advanced Tips: Where to Keep Your Sinking Funds

You want safety and easy access. So avoid locking these in long-term instruments.

Here are good options:

- High-interest savings accounts

- Recurring deposits (RDs)

- Liquid mutual funds (for slightly higher returns with quick access)

These options keep your money available while generating small returns, making the simple way to pay for big expenses without taking loans even more rewarding.

Are Sinking Funds Enough, Or Do You Still Need Loans Sometimes?

Sinking funds work best for predictable expenses. But even the best budgeting method can’t cover sudden emergencies like major medical crises or unexpected job loss. For that, you must still keep an emergency fund (3-6 months of expenses).

So think of sinking funds and emergency funds as two financial safety nets:

- Sinking fund → planned big expenses

- Emergency fund → unforeseen shocks

External Authority Resources for Smart Planning

Here are some trusted resources to deepen your understanding of paying expenses without debt:

🔹 NPS & Mutual Fund Basics: Moneycontrol guides explain how to save and invest smartly without borrowing. Moneycontrol

🔹 Expense Hacks & Savings Tips: Practical saving strategies help you free up money for sinking funds. Moneycontrol

🔹 Credit Card & Loan Insights: Understanding credit behavior helps you avoid common debt traps. Moneycontrol

These links offer practical backup to the simple strategy explained here.

Conclusion

The most reliable and simple way to pay for big expenses without taking loans is not magic — it’s planning and discipline. With a sinking fund, you spread a large predictable cost into small, manageable monthly contributions.

- No interest

- No EMIs

- No debt stress

- Better cash-flow management

Instead of letting large bills disrupt your life, a sinking fund makes them predictable and manageable. That’s the true financial freedom many people miss.

For more on budgeting and financial planning, explore our posts on creating an emergency fund for financial security, step-by-step mutual fund investment guide, practical budgeting tips for families, and credit card strategies to avoid debt to help you strengthen your overall financial foundation.

FAQs

What is a sinking fund in personal finance?

A sinking fund is a savings method where you set aside money monthly for large predictable expenses so you don’t need loans.

How does a sinking fund help avoid loans?

By saving regularly, you accumulate the total amount needed before the cost arrives, eliminating the need for borrowing.

Can sinking funds replace emergency funds?

No — sinking funds are for planned costs; emergency funds are for unexpected financial shocks.

Where should sinking fund money be kept?

High-interest savings accounts, liquid funds, or recurring deposits work well.

What expenses can a sinking fund cover?

School fees, insurance premiums, major repairs, travel, or household upgrades.

📌 Sources

- Most people pay big predictable costs out of credit because timing causes stress — sinking funds solve it. Moneycontrol

- Moneycontrol offers various savings and budgeting tips relevant to this strategy. Moneycontrol

- Understanding credit behavior helps avoid unnecessary borrowing. Moneycontrol